Irish whiskey sits at the heart of a global market. Distillers in Ireland make a premium spirit that people enjoy on every continent.

Exports drive the category. Most bottles leave the island and land on shelves in faraway cities. Tariffs shape this journey. A single rate can change price, profit, and plan.

Trade policy does not move in a straight line. Countries set rates. Leaders bargain. Deals rise, then stall. Markets react fast. A new tariff can raise the shelf price in a week.

A cut can open a door that looked shut for years. Distillers must plan for both. They cannot wait for a perfect climate. They need clear facts and smart choices.

This guide explains those facts. You will see what tariffs are, how they work, and why they matter to Irish whiskey more than most goods. You will learn about the United States, India, China, and other big markets.

You will see how rules touch labels, casks, and bottling sites. You will also get steps you can use. The goal is simple. Help you make good choices with less risk and more control.

Tariffs 101: What They Are and Why They Matter

Tariffs are taxes on imports. A government sets a rate. Customs collects it at the border. Rates may be a percentage of the value. Some rates use a fixed amount per unit. Both forms add cost.

Tariffs change the final price that a buyer pays. A higher rate can raise the shelf price or squeeze margins. A lower rate can open a path to growth.

Spirits feel shifts fast. Price ladders in bars and stores are tight. A small change can move a brand up or down a step. That step can alter demand.

Irish whiskey depends on exports. Most production ships are abroad. This makes the category more sensitive to tariffs than goods that sell mostly at home.

A new rate in a big market can move national output, jobs, and investment. Distillers need clear data and steady plans to face this.

The U.S. Market: Big Volume, Big Risk, Big Reward

The United States is a top market for Irish whiskey. Many brands built their global story there. A change in U.S. policy hits the category hard.

In recent years, the U.S. and the EU have moved between dispute and dialogue. Spirits got pulled into those moves.

A 10% U.S. tariff on EU wine and spirits came into view during 2025 trade talks. Industry groups warned that even 10% hurt margins and that a higher rate could force smaller makers to pull back.

In late July 2025, reports said the rate on EU wine and spirits could rise to 15% from August 1 unless a new deal landed in time.

The Irish Whiskey Association cautioned that exporters might shift focus to other markets if 15% stuck. These headlines reflect a wider risk. Policy shifts can reshape strategy in days.

Some press and trade outlets also noted a complex picture around carve-outs and legacy “zero-for-zero” ideas for spirits. Officials signaled talks would continue.

The message for distillers is clear. Track U.S. policy week by week. Build price and inventory buffers where possible. Prepare route-to-market plans that can flex if rates change again.

Northern Ireland vs. Republic of Ireland: Origin Can Change the Rate

Origin rules can split the island in practice. Past U.S. actions in the Boeing–Airbus dispute targeted single-malt Scotch and single-malt Irish whiskey from Northern Ireland. Later moves touched a wider set of EU drinks.

In 2025, press coverage flagged fresh differences in treatment that could create a “tariff border” for whiskey.

This risk matters for brands that distill, age, blend, or bottle in both jurisdictions. A label line can trigger a different rate. A supply step in one region can change the tariff due.

Trade policy with India shows a similar split. The UK signed a deal with India in July 2025. That deal cuts duties on whiskey from the UK side, which includes Northern Ireland. The path runs from 150% down to 40% over ten years.

Irish whiskey distilled in the Republic of Ireland did not gain that cut. It still faces a 150% MFN duty in India under current EU-India rules. That gap can shape long-term plans on where to age, finish, and bottle.

India: A Price Market with Very High Duties

India holds huge potential. The market is young, large, and thirsty for premium brands. Tariffs block the door. The MFN duty on whiskey from the EU sits at 150%.

This level makes shelf prices very high. It limits volume and slows brand growth. Talks between the EU and India have not yet delivered a cut. Industry groups keep this as a top goal.

The UK-India deal shows what a glide path can look like. Duties for UK whiskey fall in steps over a decade. A similar path for EU whiskey would change the game for Irish producers in the Republic of Ireland.

Bands should model scenarios at 150%, 100%, 75%, and 40% duty. This helps teams set price tiers, pack sizes, and channel focus in advance.

China: A Manageable Rate and Solid Headroom

China applies a 5% MFN duty to Irish whiskey. This is low next to many markets. The rate helps brands price well and build scale.

Demand for premium imports moves with income and consumer mood. Category leaders report growth in China in 2025 despite a soft global backdrop. Teams should treat China as a core leg in a balanced export plan

Other Notable Markets: A Quick Snapshot

Tariffs vary widely. A broad view helps planning. Here are examples based on recent trade briefs:

- Japan: 0% MFN. A clean path with no duty on entry.

- New Zealand: 0% MFN.

- Nigeria: 20% MFN.

- Kenya: 25% MFN pending an EU–EAC pact in force.

- Brazil and Argentina: 20% MFN. Ratification of Mercosur would phase out duties over time.

- Switzerland: 0% when whiskey fully originates in IE or NI. Non-preferential cases face a specific duty per 100 kg.

These snapshots show how a single origin or processing step can flip a shipment from 0% to a non-zero rate. Teams should confirm the current customs logic before each new route.

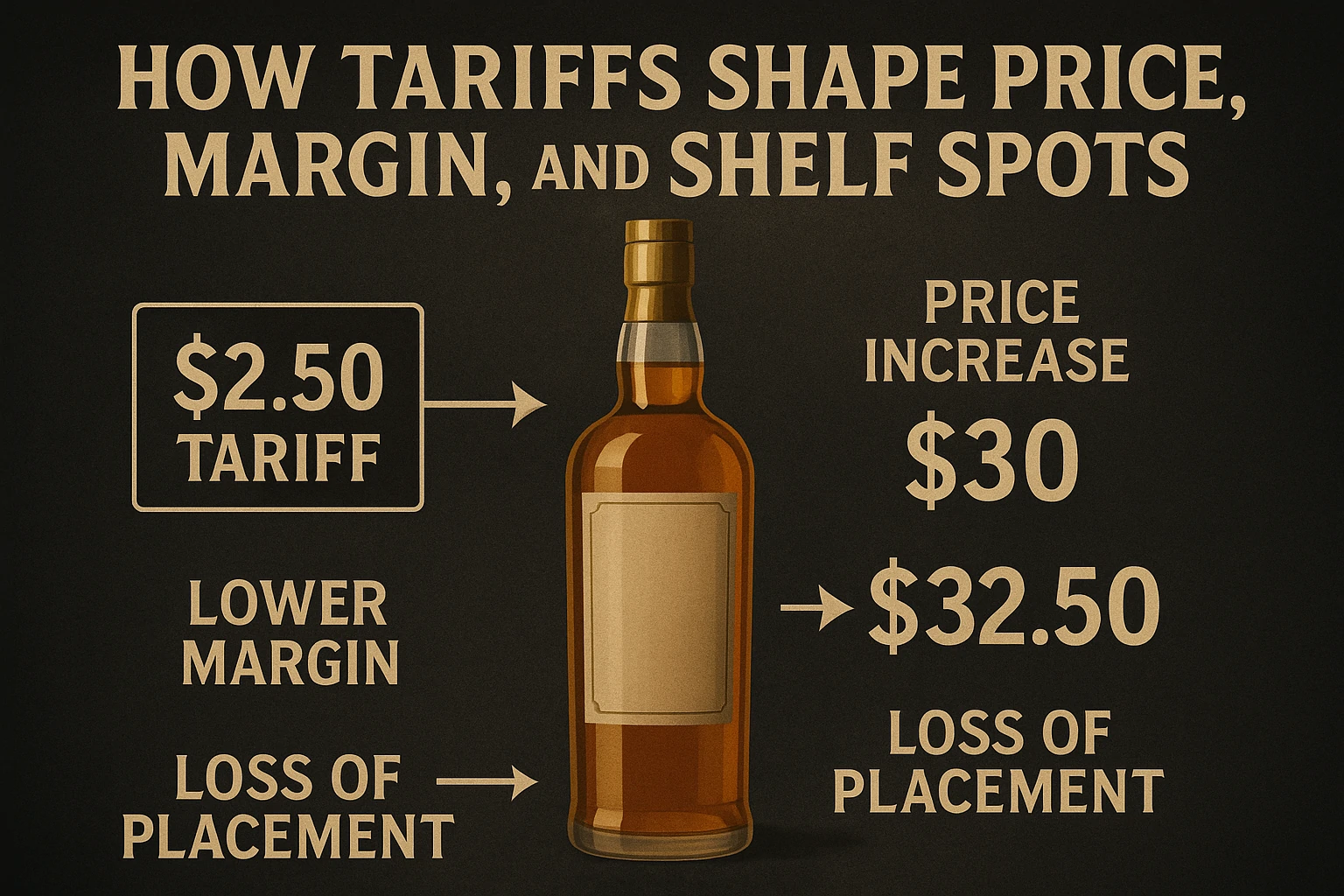

How Tariffs Shape Price, Margin, and Shelf Spots

A tariff pushes the cost up. Someone must absorb it. The producer can cut the margin. The importer can accept a hit. The distributor can trim spending. The retailer can raise prices.

Often, the chain shares the pain. Even then, the shelf price may still rise. A few points can move a bottle out of its lane. That change can cut the rate of sales.

A 10% duty looks small at first glance. In practice, it compounds with freight, insurance, taxes, and retail margin. A move to 15% adds another turn of the screw.

That can erase profit for small brands. Many smaller producers sent extra stock to the U.S. ahead of a possible rate hike in 2025. This shows how fast teams must act when policy shifts.

Brands can soften the blow. Pack size can change. Channel mix can shift. Price ladders can adjust in small, careful steps.

Limited releases can hold premium slots and protect brand value. Core SKUs can take a smaller rise. Each move needs data from scan sales, ship-to reports, and trade feedback.

Beyond Bottles: Tariffs on Inputs and Components

Irish whiskey relies on casks. Many casks come from the U.S. or other sources. A tariff on barrels or wood flows into the cost of goods.

Industry groups flagged that a 25% duty on casks or certain wood goods would hit producers hard. Teams should map exposure on cask imports, closures, glass, labels, and cases. A small rate on a heavy or bulky item can add real money per case.

Supply chain choices can ease risk. Some brands secure casks under long contracts. Some diversify suppliers across regions.

Others hold a buffer stock to ride out spikes. Each tactic trades cash flow for stability. Finance teams should test different paths and track the payoff.

Rules of Origin: The Small Print with a Big Impact

Rules of origin decide if a shipment gets a lower rate. A product must “originate” under the terms of a deal. This can mean value-added tests, tariff-shift rules, or full process steps inside a partner region.

A whiskey that crosses borders on the island of Ireland can lose a preference in a few cases. A bottle filled in one place with spirit distilled in another may face a different duty in some markets. The Swiss schedule shows this clearly. Origin drives the rate.

Export teams should keep clean records. Certificates of origin, bills of materials, and blending logs need to match the rule.

A small gap can cost the shipment its preference. That gap can turn a 0% entry into a specific or ad-valorem duty. One missed document can ripple through a quarter’s results.

Currency, Credit, and Tariffs: The Three-Way Squeeze

Tariffs rarely act alone. A weaker currency can offset a rate in one quarter, then reverse the next. A stronger dollar can help EU imports in some cases, but a weaker dollar can worsen the effect of a new U.S. duty.

Credit terms also matter. Distributors may need longer terms if price rises. That slows cash back to the distiller.

Finance teams can hedge currency. They can tie price changes to FX bands. They can stage rises across SKUs.

None of these steps erases a tariff. They buy time and smooth shocks. Use them with clear guardrails and weekly reviews.

Market Strategy Under Tariff Pressure

Rebalance the market mix. Heavy U.S. exposure adds risk in a tariff cycle. China, Japan, Australia, and EU neighbors can carry more weight if routes are stable.

India sits in a long-term plan due to its size, but current duties make volume tough. Track EU–India talks. A lower duty will change the math.

Protect brand equity. Price is not the only lever. Do not cut quality to save a point. Use format strategy, gift packs, and seasonal SKUs to protect premium cues. Keep spending behind the hero lines, even if the mix changes.

Work with trade partners. Distributors need clear calendars. Tell them when a rate may rise. Share options. Offer phased price steps. Move stock ahead of deadlines if legal and practical. Do not flood. Keep sell-through in mind to avoid write-downs later.

Practical Playbook: Step-by-Step Actions

- Map your exposure. List each market, the current rate, and any known policy clocks. Add origin rules that touch your SKUs. Use a live sheet so teams can update it.

- Model three price paths. Build base, moderate, and severe scenarios. Show landed cost, wholesale, and shelf price. Include freight and retail margin. Update when rates change.

- Set guardrails. Define when to raise price, when to absorb cost, and when to cut spending. Tie rules to margin floors and inventory norms.

- Segment SKUs. Keep a premium ladder. Use small-format or special packs to guard entry points. Protect flagship lines with careful steps.

- Prepare comms. Draft notes for importers, distributors, and key chains. Explain the change. Give dates and the why. Share what you will do to support sell-through.

- Lock supply where needed. Secure casks, glass, and closures under terms that reduce spikes. Add a safety stock if cash allows. Track carrying cost.

- Audit origin files. Confirm that each SKU has the right proof. Close gaps now. This avoids costly surprises at customs.

- Hedge smartly. Use simple FX hedges tied to shipment calendars. Avoid complex bets. Keep risk low and clear.

- Watch data weekly. Read depletions, scan, and price ladders. Adjust fast when reality differs from the plan.

- Engage policy teams. Join trade bodies. Share data that shows harm. Push for zero-tariff outcomes across both sides of the Atlantic.

Case Lens: What a 15% U.S. Duty Could Mean

Assume a mid-size brand that ships to the U.S. at a stable pace. A move from 10% to 15% adds five points on the dutiable value. The chain then adds its own margins.

Shelf price may rise more than five points in percentage terms. The brand can absorb some costs. That cuts the margin. The brand can raise prices. That risks volume. The brand can split the impact with partners. That tests relations.

Industry voices in 2025 said a move above 10% would push many companies to rethink the U.S. They might send more stock to Asia or Europe. They might delay a new state launch.

They might slow a line extension. All three protect cash in the short run. No replacement for the scale of a healthy U.S. channel. Teams should treat a 15% case as a stress test and build answers now.

Label, Pack, and Compliance: Small Choices, Big Outcomes

Labels must match rules in each market. Age statements, ABV lines, and GI terms must be correct. A small mistake can block a shipment and raise costs.

Some markets ask for duty marks or special stamps. Secure them early. Keep a master label file with local variants.

Pack choices affect duty in two ways. First, weight and volume drive freight and charges. Second, some markets define tariff lines by alcohol strength and pack type.

Check the HS code and any local rules before a pack change. Confirm that your code and description align with customs databases.

Building Resilience: People, Process, and Tools

People. Assign clear owners for trade policy, pricing, and compliance. Give them authority to act when rates move.

Process. Use a monthly tariff review. Update the exposure map. Track any public deadlines. Share a one-page brief with sales, finance, and supply.

Tools. Use dashboards for landed cost and shelf price. Automate alerts near key dates. Archive all certificates and customs entries in a single system.

These steps cut response time. They also reduce mistakes when pressure rises.

The Role of Trade Bodies and Coalitions

Trade bodies give the sector one voice. They collect data. They talk to officials. They press for zero-tariff trade.

In 2025, Irish whiskey groups warned that tariffs were stalling production, delaying investment, and even forcing closures for otherwise sound firms.

Their push was clear. End tariffs on EU and U.S. spirits and return to a tariff-free regime that worked for both sides.

Membership helps single brands punch above their weight. Your data can feed a stronger case. Your team can learn from peers. Joint action often lands better than scattered notes.

Investor View: What Tariffs Signal About Risk

Investors watch policy risk as part of the category of health. Tariffs raise cash needs and lower visibility. Brands that show a firm plan score better.

They map exposure. They hedge. They protect core price points. They keep growing in two or three regions, not one. That mix lowers risk and supports valuation even in a rough policy cycle.

Outlook: What to Watch Next

U.S.–EU talks. Watch any signals on rates, carve-outs, or a return to zero. A stable outcome would reset plans and free up spending. A rise to 15% or more would force hard choices.

EU–India track. A duty cut from 150% would unlock growth. Timelines matter. Even a small first step can help with trade tests, listings, and PR.

UK bilateral deals. The UK-India path shows how origin can split outcomes on the island. Plan route-to-market and production steps with that in mind.

Input costs. Watch for any duties or supply shocks on casks and packaging. Lock terms where needed.

Frequently Asked Questions

What tariff rate hits Irish whiskey in the U.S. right now?

Recent reports in July 2025 said wine and spirits from the EU could face a 15% tariff from August 1 unless a deal lands, up from 10%. Talks continued, and the situation for spirits had moving parts tied to past frameworks. Check current CBP guidance before you ship.

Does origin on the island of Ireland matter?

Past U.S. actions singled out certain products, and current deals can split outcomes for Northern Ireland and the Republic. Always confirm rules of origin and any specific measures that may apply to your SKU.

How high is India’s tariff on Irish whiskey?

EU whiskey faces a 150% MFN duty in India. The UK signed a deal that cuts duties on UK whiskey in steps, but that does not yet apply to Irish whiskey from the Republic.

What about China?

China applies a 5% MFN duty. This supports growth when demand holds.

Which markets have 0% duty?

Japan and New Zealand apply 0% MFN to Irish whiskey. Several partners offer 0% under preference rules when origin tests are met. Switzerland grants 0% in preferential cases and a specific duty when the origin does not qualify.

Do tariffs apply to casks and inputs?

Some measures can hit casks or wood products. Industry groups warned that such rates would raise costs across the sector. Check your codes and suppliers.

Conclusion

Tariffs test Irish whiskey at every stage. A rate can change price, margin, and momentum. The U.S. story shows how fast the ground can move.

The India case shows how a single high duty can shut a door. China and Japan show how low rates can foster growth.

Rules of origin add another layer. A label line, a bottling site, or a cask source can flip the duty due.

Brands do not need a perfect policy to grow. They need clarity, readiness, and range. Map exposure. Model outcomes. Protect price ladders. Keep origin files clean.

Balance markets. Work with trade bodies to push for zero-tariff trade. Use this guide as a living plan. Update it as policy shifts.

Each small step builds a stronger path through a world where trade rules change, yet demand for great Irish whiskey stays strong.